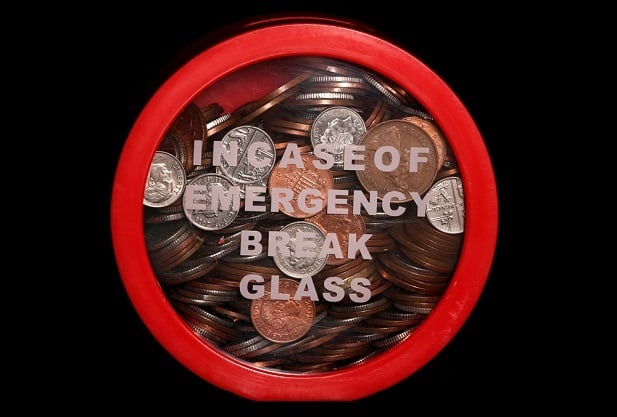

The reason emergency funds exist is to provide financial support in the case of a significant unforeseen expense, and health care costs are one of the top expenses most people will face. (Photo: Shutterstock)

The reason emergency funds exist is to provide financial support in the case of a significant unforeseen expense, and health care costs are one of the top expenses most people will face. (Photo: Shutterstock)If there were a financial 10 Commandments, establishing an emergency fund with three to six months’ worth of living expenses would be near the top. Most experts will tell you this is a critical requirement for overall financial health and well-being.

What far fewer people are talking about, though, is the importance of creating a separate emergency fund earmarked for potential health care costs. By using health savings accounts, or HSAs, as dedicated medical emergency funds, savvy savers can take advantage of unparalleled HSA tax breaks and save big money on the health care costs they incur.

Related: 7 takeaways on offering emergency savings programs in post-COVID-19 America

The reason emergency funds exist is to provide financial support in the case of a significant unforeseen expense, and health care costs are one of the top expenses most people will face. According to the Federal Reserve, 20% of adults incurred major, unexpected medical expenses in 2018, with a median cost of more than $1,000. And out of those who had significant health care costs, 40% still held debt from those expenses by the end of the year.

For many people, large and unexpected health care costs are unfortunately likely to be a question of when, rather than if. But according to an RxSaver survey, less than one in three people have a dedicated medical emergency fund set up.

This could be due to people thinking that when it comes to saving for health care expenses, all savings accounts are created equal. However, just by choosing HSAs as their medical emergency funds, smart consumers can unlock significant discounts on their health care costs. Money goes into an HSA tax-free or tax-deductible, earnings and interest grow tax-free, and funds withdrawn for qualified medical expenses are tax-free as well. There may be no such thing as a free lunch, but HSAs are the next best thing.

Since HSAs don’t have use-it-or-lose-it limits, funds can stay growing until they’re needed. HSA funds can even be invested to cover retirement health care costs. In addition, HSAs are portable, meaning they stay with account holders when they change jobs or retire. And finally, account holders can use HSA funds to pay for their spouse and tax dependents’ medical expenses tax-free, even if they’re on different health plans.

These features make HSAs the hands-down best choice for saving for current or future health care costs. And knowing how frequently unexpected medical expenses occur, building up HSA funds to cover those costs is an easy and powerful way to stretch savings farther.

Building up an emergency fund is an essential foundation for financial security. But rather than keeping everything in one account, consider dedicating a portion of savings into an HSA. By establishing HSAs as your medical emergency fund, you can ensure you’re saving the most money possible on health care expenses and paving the way for a happy, healthy future.

James Denison is director of marketing for HealthSavings, one of the country’s original health savings account (HSA) providers. HealthSavings empowers consumer-driven health plan participants to invest in institutional-class funds so they can grow their savings tax-free and meet their financial goals for a happy, healthy future. Denison is passionate about HSAs as a retirement strategy, health care consumerism, and medical cost transparency.

Read more:

"emergency" - Google News

June 04, 2020 at 09:31PM

https://ift.tt/2Xyb7oS

Why consumers should have a dedicated medical emergency fund - BenefitsPro

"emergency" - Google News

https://ift.tt/2VVGGYQ

https://ift.tt/3d7MC6X

emergency

Bagikan Berita Ini

0 Response to "Why consumers should have a dedicated medical emergency fund - BenefitsPro"

Post a Comment