- The coronavirus pandemic public health emergency (PHE) has caused a lot of uncertainty in the healthcare industry, especially for frontline physicians in emergency medicine.

The PHE has threatened the financial stability of our healthcare safety net.

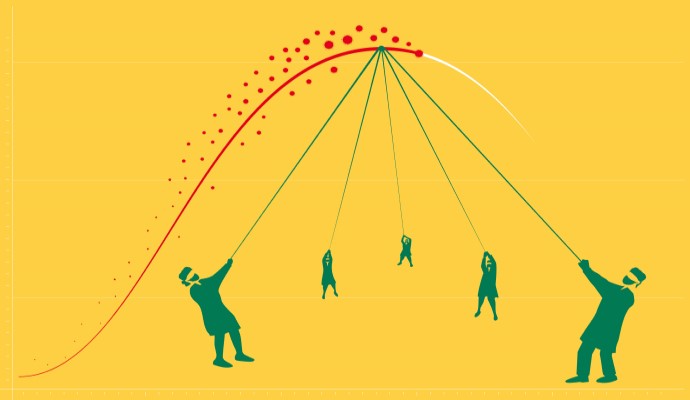

Approximately two-thirds of emergency physicians are part of an independent physician practice, and many of these groups are now facing a significant financial crisis. Historically, there has been a consistent flow of patients to emergency departments around the country, but the PHE has now caused many patients to delay or forgo emergency care. As a result, many emergency departments experienced a quick and significant decline in patient volume.

During this same period, however, emergency departments also began to see a growing population of possible COVID-19 patients. So, they began to add staff as they prepared for a worst-case scenario despite their shrinking patient volume on the other side of the business.

“The public health crisis not only stretched resources, it also forced many physician groups to make tough decisions based on their declining revenue,” explains Andrea Brault, MD, President and CEO of Brault Practice Solutions. “Unfortunately, many provider groups were left in limbo as the industry waited for guidance on reimbursement. These ED groups were forced to absorb much of the crisis’ impact, and many of them did so without knowing whether they could remain solvent in the coming months.”

Congress announced that COVID-19 testing would be universally covered, but what about treatment?

In the early months of the COVID-19 crisis, the Family First Coronavirus Response Act (H.R. 6201) required insurers to waive patient cost-sharing when their provider determines it is “medically appropriate for the individual.” Later adjustments were also made by the FFCRA and the CARES Act, but they only covered out-of-pocket or cost-sharing expenses for testing (not treatment).

“The emergency medicine industry has a standard way of communicating services and procedures linked with diagnoses codes, so that a payer understands what happened in the health care encounter,” explains Dr. Brault. “But what happens when a new illness is introduced, and there’s no way to communicate the service you’re providing?”

“This led to widespread confusion,” adds Dr. Brault. “The industry was forced to scramble and account for those instances where patient cost-sharing wasn’t allowed, and when it was. And neither the payers nor the providers had a clear road map on how to communicate services related to the crisis.”

The result was payers refusing to pay the cost-sharing portion for treatment; patients being unsure of what they should be responsible for; and providers trying to manage their decreasing cash flow.

Provider Relief Fund attempts to soften the financial impact on providers.

The CARES Act also created the Provider Relief Fund, but the use of this payment was restricted, “to prevent, prepare for, and respond to coronavirus, and reimburse healthcare-related expenses or lost revenues attributable to coronavirus.”

“This was a welcome gift from CMS,” explains Dr. Brault. “We estimate that each group received approximately 2 percent of gross patient revenue. However, we also know that most groups were experiencing a decline in patient volume of 50 percent beginning in March, and many groups are still down about 20 percent to this day.”

However, to accept the cash infusion, providers needed to sign an attestation, which included a clause that would prohibit these providers from balance billing for treatment related to COVID-19.

“At face value, this makes perfect sense. Based on the President Trump’s statements, patients are not expecting to be in the middle of a billing dispute related to seeking treatment for possible COVID-19,” continues Dr. Brault. “However, early in the process, HHS had also announced that it ‘views every patient as a possible case of COVID-19.’”

Fortunately, this language was later updated to read that “a presumptive case of COVID-19 is a case where a patient’s medical record documentation supports a diagnosis of COVID-19, even if the patient does not have a positive in vitro diagnostic test result in his or her medical record. (Modified 6/12/2020).” However, this new language did not protect patients from significant out-of-pocket expenses, depending on their deductible and co-insurance. Typically, the claim would need to be appealed to ensure the correct level of out-of-pocket expenses.

Congress has now released three disbursements from this fund, the latest of which was announced on October 1, 2020. However, details on the application process or eligibility criteria have not been released.

Can providers receive financial support for treating uninsured patients? Sometimes.

The healthcare industry continues to see progress by making sure government and commercial payers are paying their fair share. But what about the growing population of uninsured that have been caused by rapidly rising unemployment?

There is a federal program that provides reimbursement for some COVID-19 testing and treatment for uninsured patients. However, the program only covers services for a narrowly defined set of testing and treatment circumstances. Under the coverage guidelines for “treatment,” the claim must include a primary diagnosis for COVID-19.

“We now have payer codes and guidance that applies to encounters on or after April 1, 2020. And there’s entirely different guidance for encounters prior to that date,” explains Dr. Brault. “There’s a lot of moving parts coming at us here. But, it’s really just a matter of sitting down and studying the material – digging through hundreds of pages of laws and regulations to determine a way forward.”

Independent physician practices should be seeking resources to help them weather the storm.

There’s a lot of confusion in the marketplace, but Dr. Brault explains that resources are available for those who want to be proactive. She recommends:

- Start with industry associations, such as EDPMA and ACEP. These groups often have committees that produce FAQs to help educate providers, as well as dedicated campaigns to help educate lawmakers about the impact of proposed legislation. These are great places for a higher-level understanding of these issues.

- Staying in close contact with revenue cycle partners. Provider education should be a primary focus for all physician groups, and RCM partners should be proactive in helping providers understand proper documentation, working through all the accounts receivable, and helping manage payer relationships.

“As an industry, we must all be aware of these challenges and opportunities,” explains Dr. Brault. “We must also consider the trajectory of laws and regulations that can change the way you manage your physician practice.”

_____________________________________________________________

Article Contributers:

Dr. Andrea Brault – President & CEO, Brault Practice Solutions

About Brault:

Brault is a revenue cycle and practice management organization that partners exclusively with hospitals and acute care physician groups. Their intelligent practice solutions include MIPS optimization, practice analytics, and provider documentation training. Learn more at www.Brault.us

About C3 Partners, LLC:

C3 Partners provides next-level MACRA Optimization through unique tools and powerful collaboration, as outlined in a clear Monthly MACRA blueprint. See www.MACRAmonitor.com for more details.

"emergency" - Google News

October 05, 2020 at 09:21PM

https://ift.tt/30zjvFP

Navigating the Public Health Emergency in Emergency Medicine - RevCycleIntelligence.com

"emergency" - Google News

https://ift.tt/2VVGGYQ

https://ift.tt/3d7MC6X

emergency

Bagikan Berita Ini

0 Response to "Navigating the Public Health Emergency in Emergency Medicine - RevCycleIntelligence.com"

Post a Comment