Executive Summary

- The COVID-19 relief package out of Congress includes, among other provisions, explicit language concerning the Federal Reserve’s emergency lending facilities.

- $429 billion in uncommitted funds are rescinded and five of the Fed’s programs, most obviously the Main Street Lending Program, will cease operation December 31, 2021.

- The Fed failed to employ billions authorized to it by the CARES Act; these funds can be better used elsewhere, and by more appropriate bodies than the central bank.

Introduction

Nine months after the last legislative response to the unique economic and social dangers posed by COVID-19, the trillion-dollar Coronavirus Aid, Relief, and Economic Security (CARES) Act, Congress has agreed on a second $900 billion legislative package, tied to a larger government funding bill snappily titled H.R. 133, The Consolidated Appropriations Act, 2021. Key aspects of the package include: a ten-week $300 period of jobless benefits; another round of stimulus checks, this time $600 per person; the re-authorization and additional funding of the Paycheck Protection Program; $25 billion in emergency rental assistance; and curbing the Federal Reserve’s (Fed) emergency lending powers. This piece focuses on the potential implications for the Fed’s emergency lending facilities.

Context

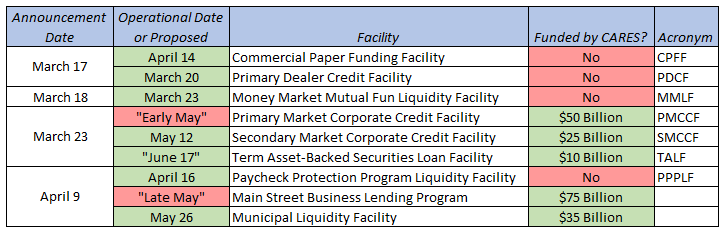

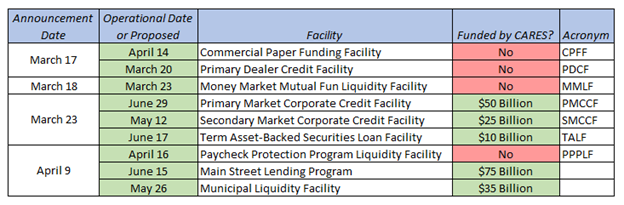

Since the onset of the coronavirus pandemic, the Fed has moved more decisively and more quickly in a matter of weeks than in the previous century of its operation. In addition to cutting its key interest rate to zero percent and embarking upon a considerable round of quantitative easing, the Fed introduced or reintroduced nine emergency lending facilities, some de novo and some created by Fed Chair Bernanke in the 2007-2008 financial crisis under the emergency 13(3) powers created by the 1913 Federal Reserve Act. Of these nine facilities, five benefitted from equity investments by Treasury using the $454 billion appropriated by the CARES Act. The status of these facilities is provided below.

As of the end of September, these programs had provided about $2 billion of the $600 billion the Fed is authorized to back. Proponents of these programs note that even outside of the provision of direct funding the mere existence of these programs served to stabilize markets.

The Proposed Act

The relief package has three key aspects. The Act –

- rescinds all remaining funds authorized by the CARES Act that have remained uncommitted, estimated to be at least $429 billion;

- “reiterates” that the Fed’s authority over these funds, and by extension the operation of the five emergency lending programs funded by CARES, expires December 31, 2020, as provided for by the CARES Act; and

- establishes that the Fed cannot restart these five emergency lending facilities without the express consent of Congress (except TALF, because it predates the current crisis).

The Act, however, does not otherwise limit the Fed’s abilities to provide emergency relief as per statue.

Conclusions

The status of the Federal Reserve’s emergency lending facilities became a surprise last-minute roadblock to Congress’s efforts to provide a second major legislative package. While few are willing to categorically applaud the Fed’s facilities and use of CARES funds, Democrats may have hoped that a new administration, and Treasury under Janet Yellen, could significantly alter the terms of existing programs to make it easier, and more attractive, to use these funds. While Congress clearly originally intended for the funds to be used, it also clearly intended for these programs to expire at the end of the year. The Fed’s relative failure to employ these programs (particularly by comparison to the speed, effectiveness, and overall funds disbursed via the Paycheck Protection Program), suggests that this was not the most desirable mechanism for aid in any event, and concern remains that it is not the most appropriate expansion of the Fed’s responsibilities as supervisor and regulator.

Note: Changes to the Full-Text RSS free service

"emergency" - Google News

December 22, 2020 at 10:10PM

https://ift.tt/2M0QRZP

A New Congressional COVID-19 Relief Bill and The Federal Reserve's Emergency Lending Facilities - AAF - American Action Forum

"emergency" - Google News

https://ift.tt/2VVGGYQ

https://ift.tt/3d7MC6X

emergency

Bagikan Berita Ini

0 Response to "A New Congressional COVID-19 Relief Bill and The Federal Reserve's Emergency Lending Facilities - AAF - American Action Forum"

Post a Comment